If you are a VAT-registered business and the value you are invoicing is less than £250, you have the option of issuing a VAT simplified invoice. The total amount of VAT chargeable – you can invoice in any currency you like but the VAT chargeable must always be shown in sterling.Rate of VAT charged per item – where items are zero-rated or exempt, it must be clear that there is no VAT charged on those items.

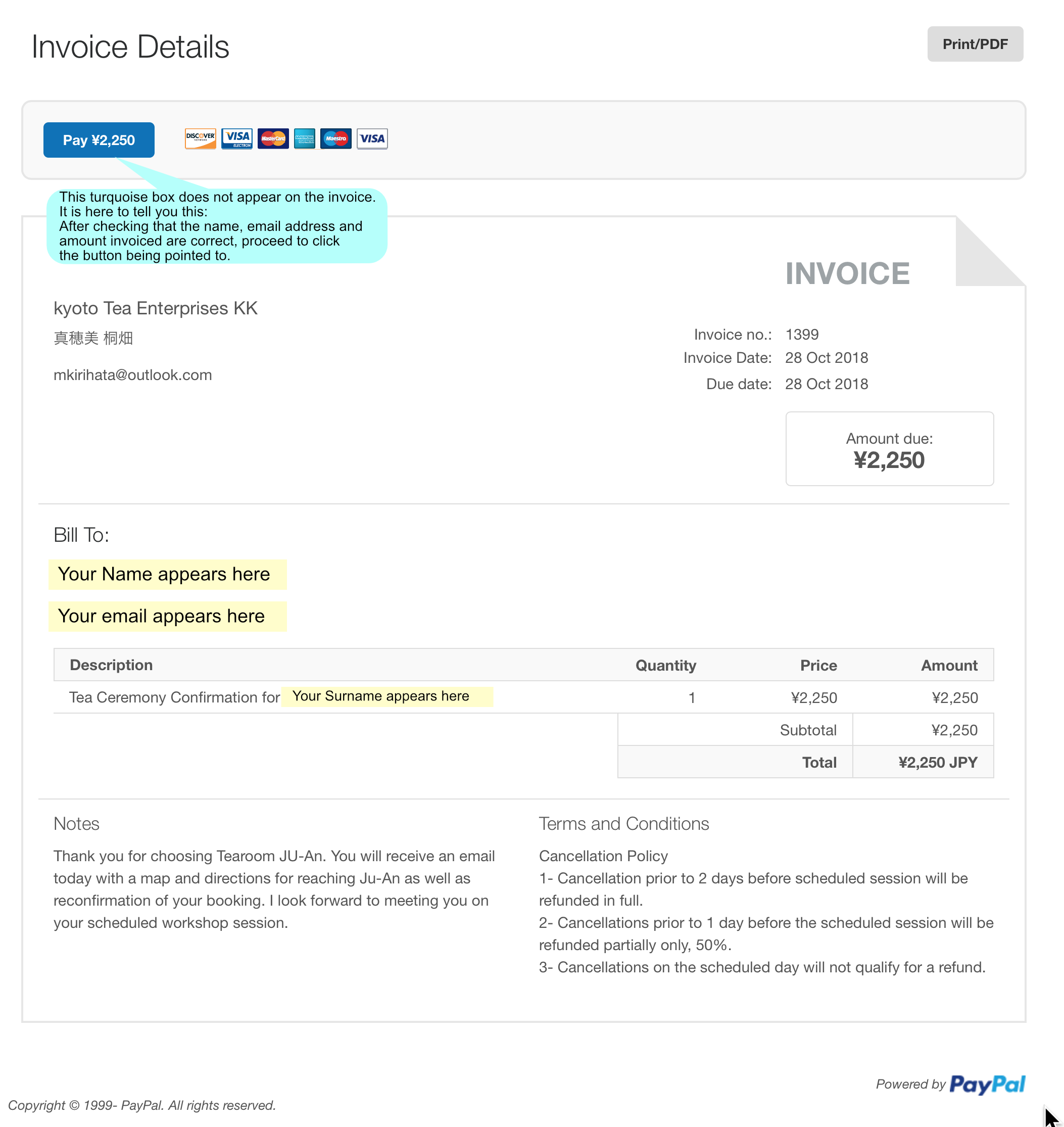

#PAYPAL INVOICE REGISTRATION#

#PAYPAL INVOICE FULL#

Full company name – as shown on the company’s certificate of incorporation.If your business is a limited company, you must include: Address - where any legal documents can be delivered.Your name and any business name you use – for example, “John Smith trading as Elegant Fireplaces”.If you’re a sole trader, you also need the following: The amount being charged, VAT amount and total amount due – only apply VAT if your business is VAT registered and VAT is applicable to the sale.The date the goods or services were provided – this may be different from the invoice date.Invoice date – this is the date on which the invoice is created and from which payment is due.A clear description of what you are charging for.Your business name, address and contact information – and, just to be clear, that should be a real, postal address.If your business is registered for VAT then the numbering must be sequential, with no gaps. A unique reference number – each invoice must have a unique number.Common sense suggests you have that in large letters near the top. “Invoice” – every invoice must clearly include the word “invoice”.What every invoice needs Whatever type of business you have (sole trader or limited company, VAT registered or not), you must include the following on every invoice: If there are any disputes, then your invoice is a record of what was provided, and the payment requested. If your invoice is easy to understand, error-free and includes all the information your customer needs, then it will help speed payment. It’s also an important legal document that states what you provided and makes a formal request for payment. What is an invoice? According to the Oxford English Dictionary, an invoice is: A list of goods sent, or services provided, with a statement of the sum due for these. And then, like everyone else who’s not an accountant, you find you don’t really know what an invoice ought to include. You’ve defined your product or service, you’ve bought your stock, you’ve got your very first customer! But, they need an invoice.

0 kommentar(er)

0 kommentar(er)